In the world of trading, recognizing patterns can significantly boost your success. One such valuable pattern is the reciprocal AB=CD. This article will delve into what this pattern is, how it works, and how you can use it to make smarter trading decisions in the Indian market.

What is the Reciprocal AB=CD Pattern?

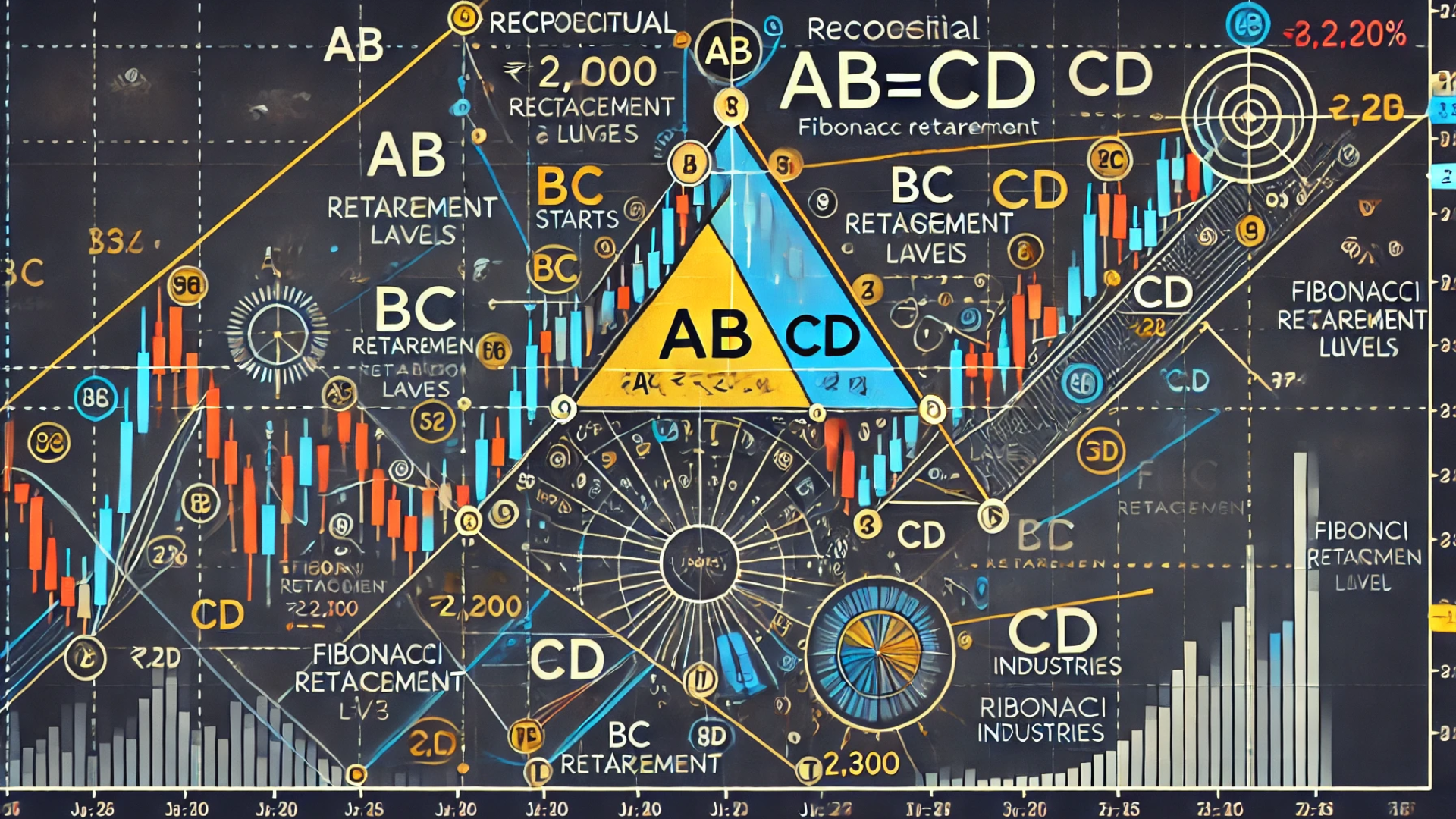

The reciprocal AB=CD pattern is a harmonic pattern used in technical analysis. Harmonic patterns, in general, use Fibonacci numbers to identify potential reversal points in the market. The AB=CD pattern, specifically, is formed by two equal-length price segments.

Here’s a simple breakdown:

- AB and CD are two legs of the pattern.

- BC is a corrective leg, often a retracement of AB.

- The key point is that AB equals CD in terms of price distance.

When you see this pattern forming, it can signal a potential reversal, providing traders with opportunities to enter or exit positions.

Identifying the Reciprocal AB=CD Pattern

To spot the reciprocal AB=CD pattern, you need to follow these steps:

- Identify the AB leg: This is the initial price move. It can be upward or downward.

- Look for BC retracement: This leg should retrace a significant portion of the AB leg, typically between 61.8% and 78.6% of the Fibonacci retracement levels.

- Find the CD leg: This leg should mirror the AB leg in length. If AB is 100 points, CD should also be 100 points.

- Confirmation: Use additional indicators or patterns to confirm the pattern’s validity before making a trade.

Applying the Pattern in the Indian Market

Now, let’s discuss how to apply this pattern specifically in the Indian market. Whether you’re trading stocks, indices, or commodities, the reciprocal AB=CD pattern can be a reliable tool. Here’s how you can use it:

- Choose Your Instrument: Select the stock or index you want to analyze. The pattern works on various time frames, so pick one that suits your trading style.

- Draw Fibonacci Levels: Use Fibonacci tools to measure the AB leg and identify potential retracement levels for BC.

- Track Market Sentiment: Pay attention to news, earnings reports, and economic indicators that could influence the market.

- Set Entry and Exit Points: Once you confirm the pattern, determine your entry and exit points. It’s crucial to set stop-loss levels to manage risk effectively.

Examples in the Indian Market

Let’s look at a hypothetical example using a popular Indian stock, Reliance Industries:

- Identify AB Leg: Suppose the stock rises from ₹2,000 to ₹2,200 (AB leg).

- BC Retracement: The stock then falls to ₹2,100, retracing 50% of the AB leg.

- CD Leg Formation: If the stock rises again to ₹2,300, the CD leg mirrors the AB leg (both are 200 points).

- Entry Point: You might consider entering a buy position around ₹2,100 with a target of ₹2,300.

- Exit Strategy: Place a stop-loss just below ₹2,100 to minimize potential losses if the pattern fails.

Benefits of Using the Reciprocal AB=CD Pattern

- Predictive Power: It helps anticipate market reversals with decent accuracy.

- Versatility: Can be used across various financial instruments and time frames.

- Risk Management: Provides clear entry and exit points, aiding in better risk management.

Its here AB=CD Pattern in the Indian Market

Limitations to Keep in Mind

While the reciprocal AB=CD pattern is useful, it’s not foolproof. Here are a few limitations:

- False Signals: The pattern can sometimes provide false signals, especially in volatile markets.

- Complexity: It requires a good understanding of Fibonacci retracement levels.

- Confirmation Needed: Always use additional indicators or patterns to confirm the signal.

Conclusion

The reciprocal AB=CD pattern is a powerful tool for traders in the Indian market. By understanding how to identify and apply this pattern, you can make more informed trading decisions. Remember, while it’s a valuable tool, it’s crucial to use it in conjunction with other analysis methods to enhance your trading strategy.