Investing is not just a numbers game; it’s a psychological battle. Emotions play a crucial role in shaping investment decisions, often leading to significant financial consequences. This blog dives into how emotions influence investing and provides relatable examples involving Indian names to illustrate these concepts.

Investing can be an emotional rollercoaster. Fear, greed, hope, and regret often drive our decisions, sometimes more than rational analysis. But how exactly do emotions affect our investment choices? Let’s explore this with some detailed examples and practical tips on managing emotional biases.

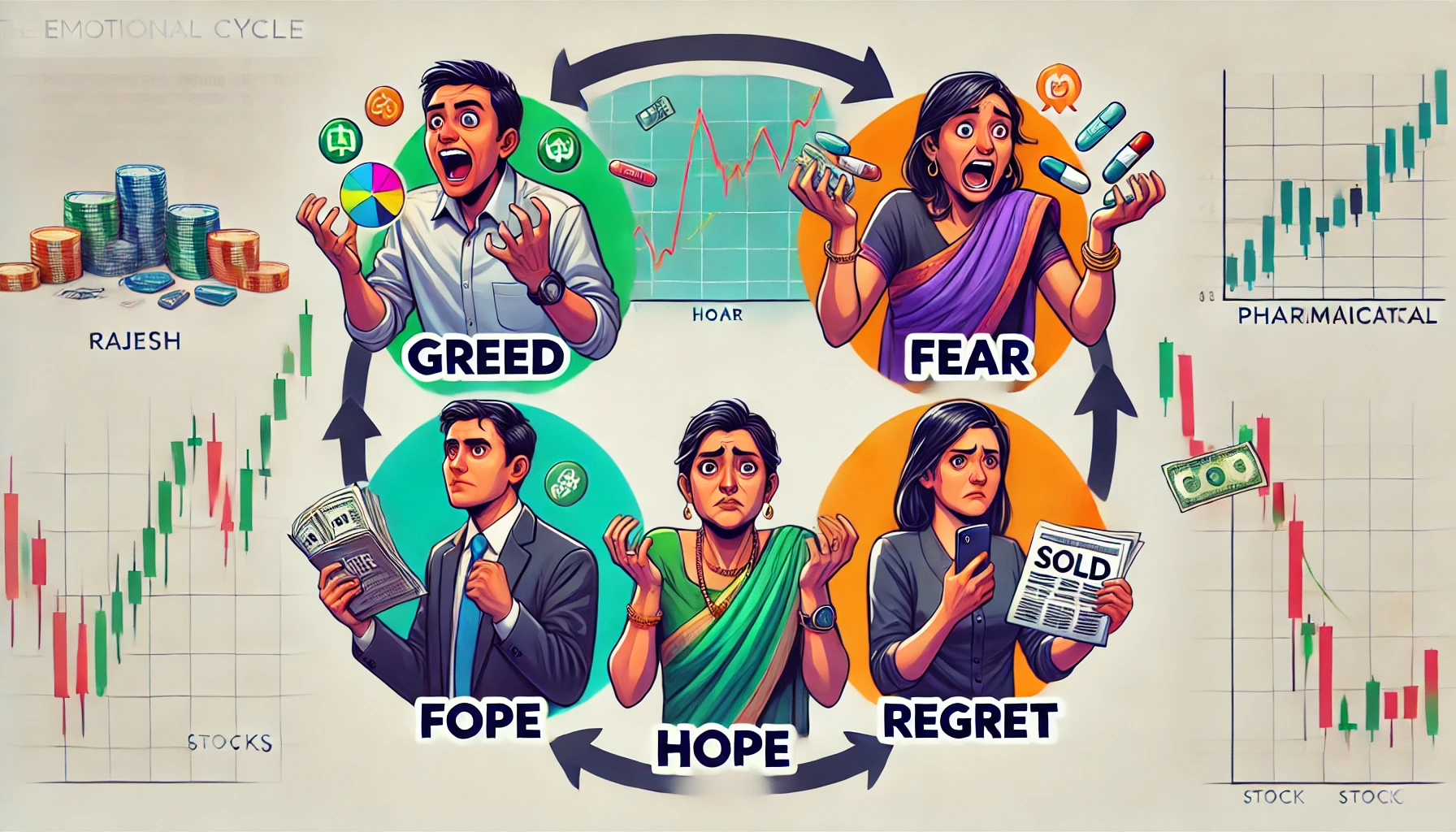

The Emotional Cycle of Investing

1. Greed

Greed is a powerful emotion that can lead to irrational exuberance. When the market is soaring, and everyone is talking about the next big stock, it’s easy to get caught up in the hype.

Example:

Consider Rajesh, who hears about a booming tech stock from his friends. Seeing the stock prices skyrocketing, he decides to invest a substantial amount, ignoring fundamental analysis. The fear of missing out (FOMO) overrides his usual cautious approach. Eventually, the market corrects, and Rajesh faces significant losses.

2. Fear

Fear, especially during market downturns, can paralyze investors or prompt them to sell prematurely.

Example:

Priya invested in a diversified portfolio of stocks. However, during a market correction, she sees her portfolio’s value plummet. Driven by fear, she sells her investments at a loss, only to see the market recover a few months later, turning her temporary losses into permanent ones.

3. Hope

Hope can sometimes lead to overconfidence, where investors hold on to losing investments expecting a turnaround without any rational basis.

Example:

Amit bought shares in a once-promising pharmaceutical company. Despite continuous negative news and declining stock prices, Amit clings to hope and keeps his investment, waiting for a miracle recovery. This emotional attachment blinds him to better opportunities elsewhere.

4. Regret

Regret often follows hasty decisions, influencing future investment choices and potentially leading to missed opportunities.

Example:

Sonia regretted selling her shares in a startup too early, missing out on massive gains. This regret made her overly cautious, and she missed several good investment opportunities because she feared repeating her past mistake.

It’s Here ETFs vs. Mutual Funds you need to know

Strategies to Manage Emotional Investing

1. Create a Plan

Having a well-defined investment plan can help mitigate emotional decisions. This plan should include your financial goals, risk tolerance, and asset allocation strategy.

Example:

Arjun sets clear financial goals and adheres to an asset allocation strategy that balances his portfolio across various asset classes. This disciplined approach helps him stay focused even during market volatility.

2. Set Realistic Expectations

Understanding that markets fluctuate and having realistic expectations can reduce the emotional impact of short-term market movements.

Example:

Kavita educates herself about market cycles and expects some degree of volatility. This knowledge helps her maintain composure during downturns and avoid panic selling.

3. Diversify Your Portfolio

Diversification can reduce risk and smooth out the emotional ride of investing.

Example:

Anita diversifies her investments across stocks, bonds, real estate, and mutual funds. This diversification helps cushion her portfolio against market volatility and reduces the emotional stress of losing money in one asset class.

4. Regularly Review and Rebalance

Regularly reviewing and rebalancing your portfolio ensures it stays aligned with your goals and risk tolerance.

Example:

Manoj reviews his portfolio every six months and rebalances it to maintain his desired asset allocation. This practice prevents emotional decisions driven by market highs or lows.

5. Seek Professional Advice

Sometimes, consulting with a financial advisor can provide an objective perspective and help manage emotional biases.

Example:

Rashmi consults a financial advisor to validate her investment decisions. The advisor’s professional guidance helps her stay on track with her long-term goals, reducing emotional decision-making.

It’s here Investor Mindset at time of inflation

Conclusion

Emotions play a significant role in investing, often leading to impulsive and irrational decisions. By recognizing the impact of emotions and employing strategies like planning, diversification, and professional advice, investors can better manage their emotions and make more rational investment choices. Remember, successful investing is as much about managing your emotions as it is about understanding the markets.

For further reading, consider exploring resources like “The Psychology of Money” by Morgan Housel, which delves deeper into the behavioral aspects of investing.