Ever wonder why some businesses seem to always stay afloat while others struggle? It often comes down to one key factor cash flow. Understanding cash flow is crucial for any business, big or small. Let’s dive into what cash flow really means and how you can maintain it to keep your business thriving.

What Is Cash Flow?

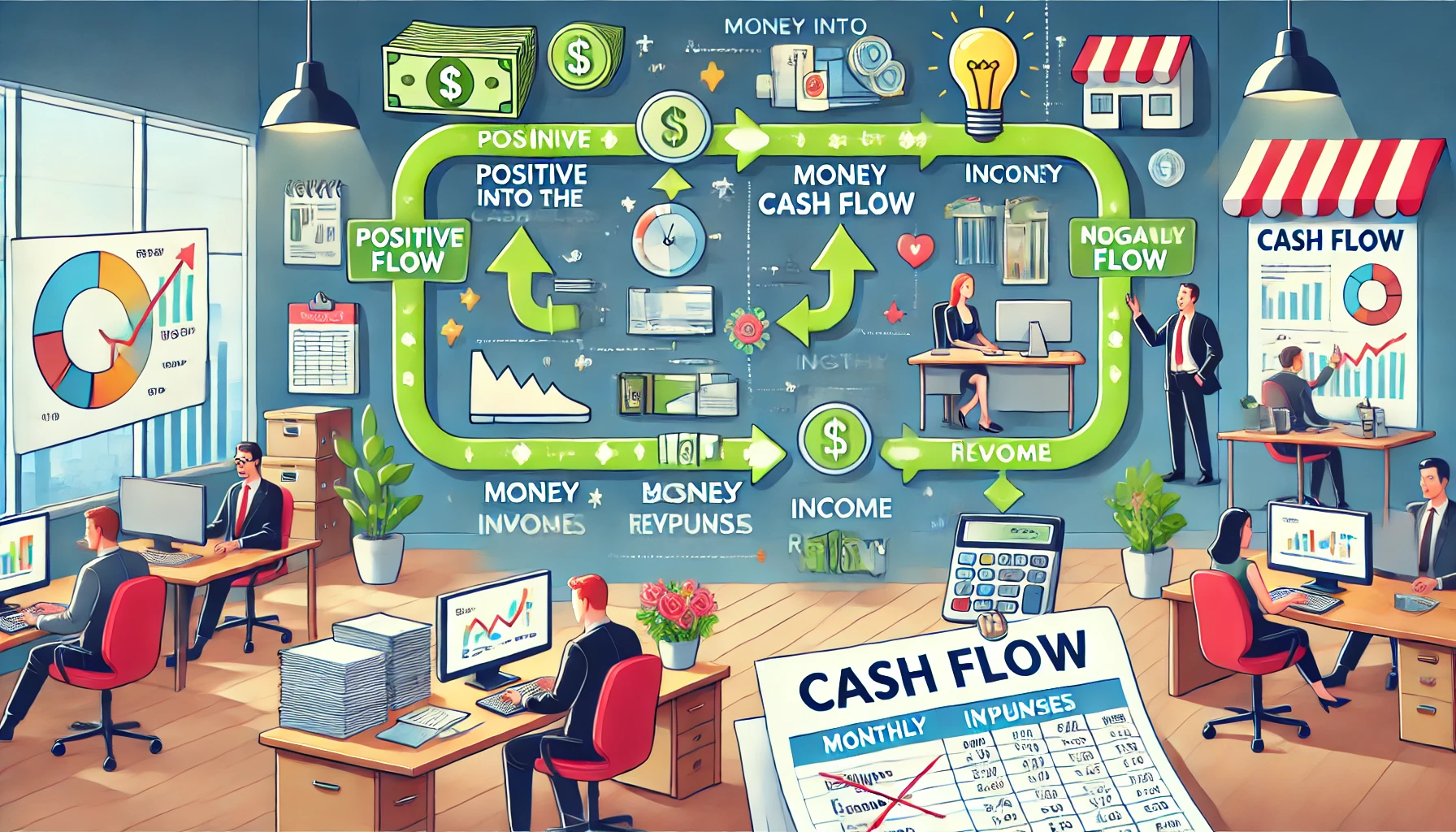

Cash flow is the movement of money in and out of your business. Think of it like the bloodstream of your company. Just as blood delivers essential nutrients to keep your body healthy, cash flow ensures your business has the funds it needs to operate smoothly.

- Positive Cash Flow: More money is coming into your business than going out.

- Negative Cash Flow: More money is leaving your business than coming in.

Positive cash flow means your business can pay its bills, invest in new opportunities, and grow. Negative cash flow, on the other hand, can lead to financial trouble.

Why Is Cash Flow Important?

- Paying Bills on Time: From rent to salaries, you need cash to meet your regular expenses.

- Investing in Growth: Whether it’s new equipment, marketing, or hiring staff, you need funds to expand.

- Handling Emergencies: Unexpected costs come up. A healthy cash flow acts as a buffer.

- Maintaining Relationships: Paying suppliers and vendors on time helps build trust and strong business relationships.

How to Maintain Cash Flow

Monitor Regularly:

- Keep a close eye on your cash flow statements.

- Use accounting software to track your inflows and outflows.

Improve Receivables:

- Invoice promptly and follow up on late payments.

- Consider offering discounts for early payments to encourage faster cash inflow.

Manage Payables:

- Negotiate better payment terms with suppliers.

- Pay your bills on time, but not too early. Hold onto your cash as long as possible without incurring late fees.

Control Expenses:

- Cut unnecessary costs.

- Look for ways to reduce regular expenses, like renegotiating contracts or finding more affordable suppliers.

Build a Cash Reserve:

- Save a portion of your profits to create a cash buffer.

- Aim for enough savings to cover at least three to six months of operating expenses.

Plan for the Future:

- Create a cash flow forecast to anticipate future financial needs.

- Adjust your plans based on expected cash inflows and outflows.

Tips for Healthy Cash Flow

- Invoice Quickly: Don’t delay sending out invoices. The sooner you bill, the sooner you get paid.

- Offer Multiple Payment Options: Make it easy for customers to pay by offering various payment methods.

- Review Financial Statements: Regularly review your balance sheet, income statement, and cash flow statement.

- Avoid High Debt: Keep debt to a minimum. Too much borrowing can strain your cash flow.

- Seasonal Planning: If your business has seasonal fluctuations, plan ahead to manage cash during slow periods.

Ultimate Guide Taking Business global has to know

FAQs

Q: What’s the difference between cash flow and profit?

A: Profit is the amount of money left after all expenses are paid, while cash flow is the actual money moving in and out of your business. A business can be profitable but still have cash flow problems if its income isn’t coming in quickly enough to cover expenses.

Q: How often should I review my cash flow?

A: Ideally, review your cash flow monthly. This helps you spot trends and address issues before they become major problems.

Q: Can I improve cash flow without cutting costs?

A: Yes! Improving how you manage receivables and payables can significantly impact cash flow. Faster invoicing and better payment terms are great starting points.

Wrapping Up

Maintaining a healthy cash flow is vital for the success and growth of your business. By keeping a close eye on your finances, managing expenses wisely, and planning for the future, you can ensure your business stays on solid ground. Remember, a little attention to your cash flow can go a long way in securing your business’s financial health.